Housing Policy Is Back in the Spotlight and Why 2026 Feels Different

Housing spent much of 2025 quietly becoming a policy priority again. Not loudly. Not dramatically. But consistently. Zoning reform, supply incentives, financing discussions, and affordability measures moved from talking points into actual legislative focus at both the federal and state levels.

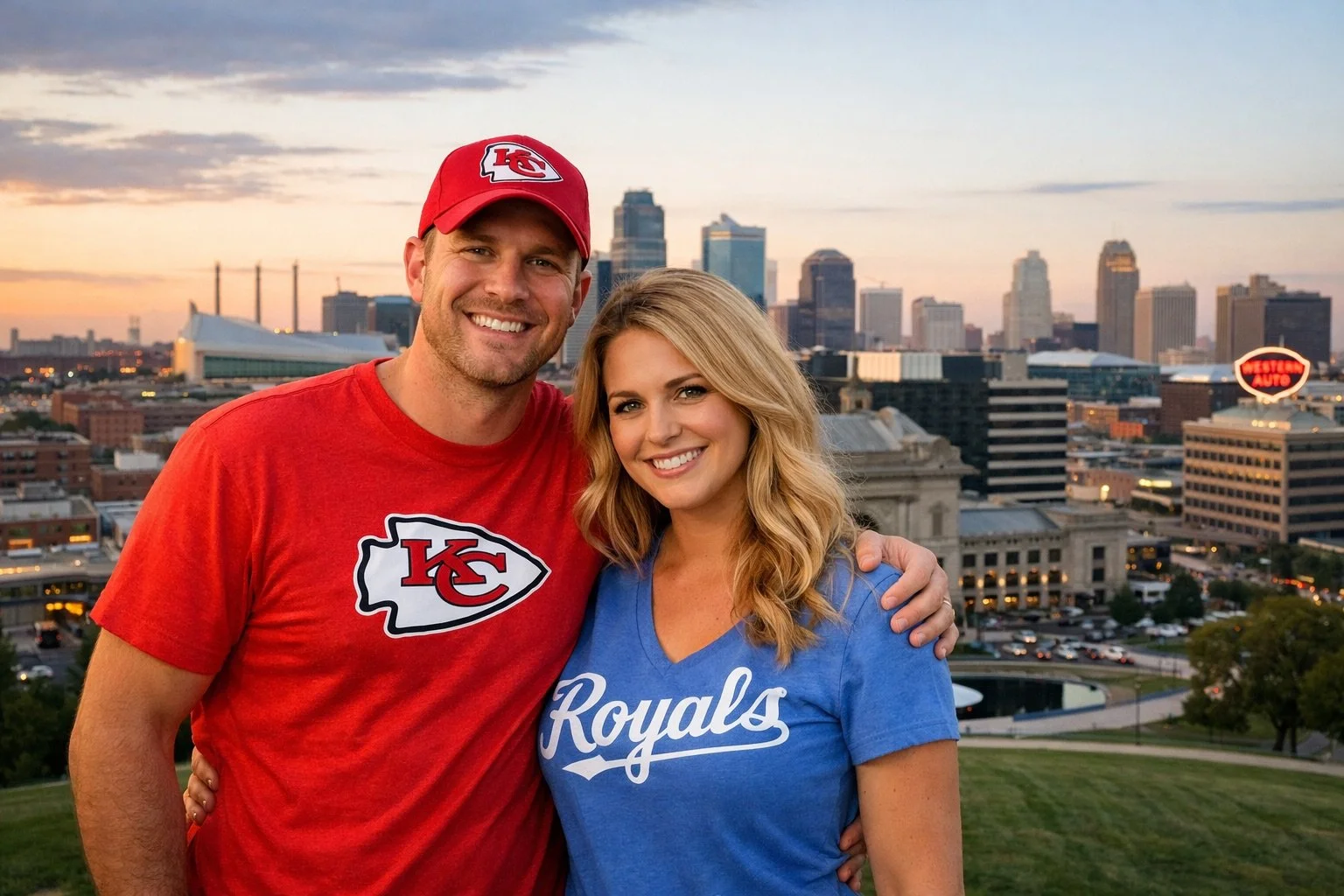

What makes 2026 interesting is not that housing is suddenly broken. It is that policymakers are now treating housing as infrastructure rather than a side effect of economic growth. That shift matters, especially in markets like Kansas City that sit in the middle of national demand patterns rather than on the coasts.

From Policy Headlines to Real Homes

Most of the national conversation is centered on supply. More housing. Faster approvals. Fewer barriers. That sounds abstract until you bring it home.

Kansas City has long benefited from a balanced mix of affordability, job growth, and livability. We are not immune to inventory constraints, but we also are not experiencing the extremes seen in some coastal metros. When federal and state policies push toward easing construction hurdles or supporting first time and move up buyers, the effects here tend to show up more quietly and more sustainably.

That is an important distinction. Kansas City rarely moves first. But when it moves, it tends to move with durability.

Why This Matters More in the Upper Price Bands

For buyers and sellers north of $500,000, policy shifts are rarely felt as a direct incentive or rebate. They show up in second order effects. Confidence. Lending stability. Construction timelines. Buyer behavior.

When housing policy stays in focus, lenders are more deliberate, builders are more predictable, and buyers feel less rushed to make fear based decisions. That steadiness supports pricing integrity, especially in higher quality neighborhoods and well located homes.

The Fosgate Perspective

What many people misunderstand right now is the idea that policy attention automatically means market disruption. In our experience, the opposite is often true in a market like Kansas City. When housing becomes a priority at the policy level, it tends to reduce volatility rather than create it.

The opportunity being overlooked is patience paired with preparation. We are advising clients to pay attention, not react. Understand how financing terms, inventory additions, and local zoning conversations may shape choices over the next 12 to 24 months, but do not assume overnight change.

If this were a close friend asking us what to do, we would say this. Make decisions based on lifestyle and long term positioning, not headlines.

What This Means If You’re Actually Moving

If you are buying, this is a reminder that you can afford to be thoughtful. Watch how inventory unfolds this spring and summer. Pay attention to quality, location, and long term usefulness of a home rather than chasing short term leverage.

If you are selling, the steady policy focus supports a buyer pool that is more confident and better informed. Pricing correctly and preparing your home well still matter far more than timing a headline.

The noise you can safely ignore is the idea that sweeping policy change will suddenly reset values. Kansas City does not work that way. It rewards measured decisions and realistic expectations.

Looking Ahead Without the Drama

Housing will likely remain part of the national conversation through 2026. That does not mean the market is unstable. It means housing is being treated as essential.

For Kansas City buyers and sellers, that is a healthy backdrop. Not a call to rush. Not a reason to wait indefinitely. Just a reminder that thoughtful, experience driven decisions tend to age well.