Keys to the Market

Unlocking Insights, One Door at a Time

Personal Residence Depreciation and the Questions It Raises for Kansas City Homeowners

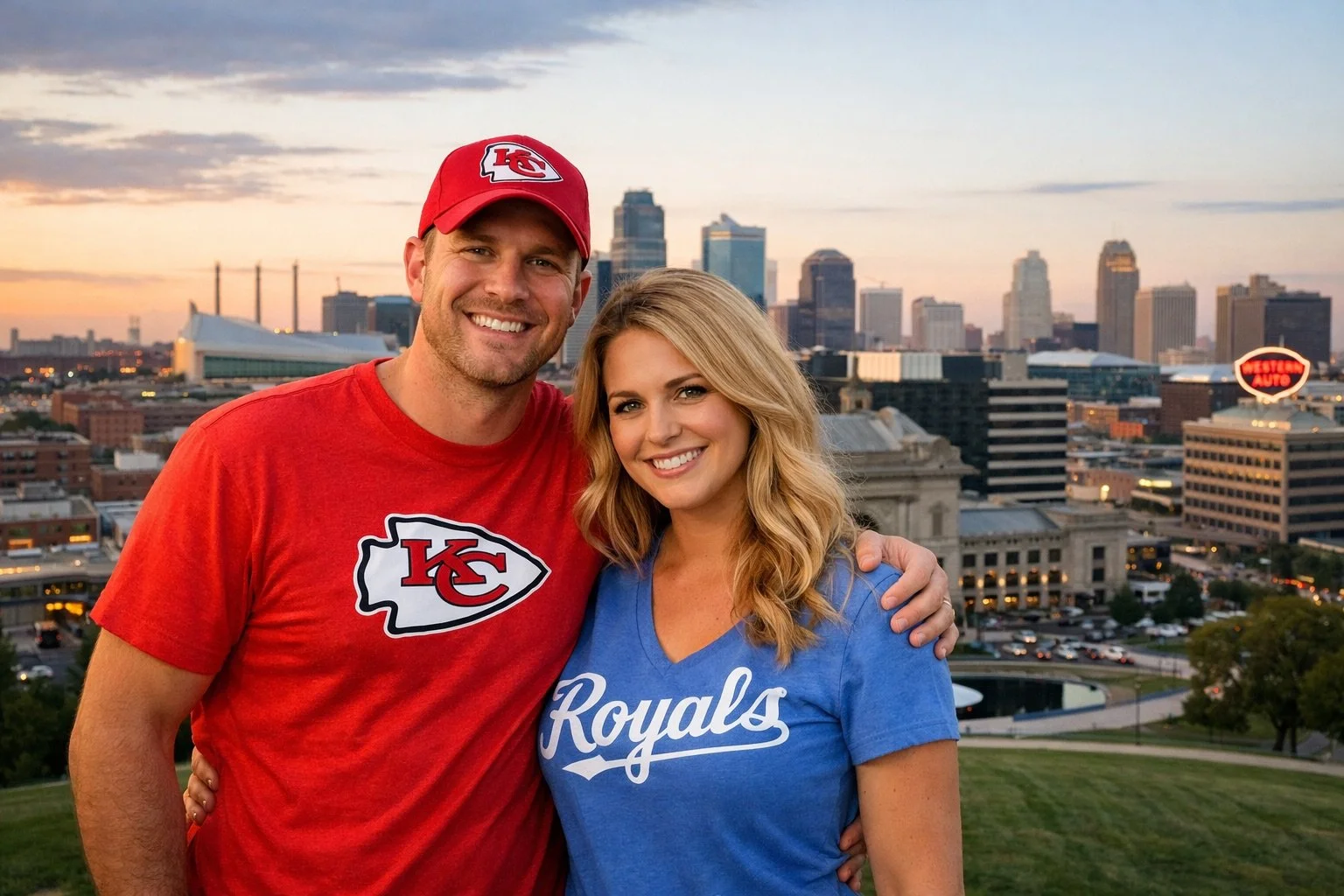

Big ideas around homeownership can sound exciting, but real decisions still happen at the kitchen table. In Kansas City, buyers and sellers are navigating tax chatter while staying grounded in what actually matters day to day. Perspective beats speculation every time.

When Policy Conversations Start Showing Up at the Kitchen Table

Policy conversations are everywhere right now, and they’re starting to show up at the kitchen table. The real question isn’t what might change someday, but how today’s decisions align with your long term plans. Perspective matters.

When AI Becomes Background Noise in Real Estate

Real estate is getting faster, not simpler. We’re seeing technology fade into the background while judgment takes center stage. The real advantage right now isn’t the tools you use, it’s knowing what actually matters in your Kansas City move.

Higher for Longer Is Settling In And Buyers Are Quietly Adjusting

Kansas City buyers and sellers are adapting to mortgage rates that are holding steady. Here’s how today’s market is actually functioning and what matters most if you’re moving.

The Quiet Power of Repair Records in Today’s Market

Kansas City buyers are paying closer attention to repair records. Here’s why documented maintenance can protect value and reduce friction for sellers in today’s market.

Housing Policy Is Back in the Spotlight and Why 2026 Feels Different

National housing policy is back in focus for 2026. Here’s how Kansas City buyers and sellers should think about supply, stability, and long term decisions in today’s market.

Smart Home Tech and the Quiet Redefinition of Aging in Place

Smart home technology is reshaping how Kansas City buyers and sellers think about aging in place, safety, and long-term livability. A calm look at what actually matters in today’s market.

Mortgage Rates Aren’t Falling Fast. But They’re Finally Predictable Again.

Mortgage rates aren’t low, but they’re steadier. Here’s how Kansas City buyers and sellers can use predictability to make smarter real estate decisions in today’s market.

Negotiation Is Back. Quietly. And It Changes Everything in Kansas City

Negotiation is quietly returning to the Kansas City real estate market. Here is what that shift means for buyers and sellers over $500,000 and how to approach offers with confidence.

The Market Isn’t Frozen. It’s Just More Thoughtful.

Kansas City’s real estate market isn’t frozen, it’s thoughtful. Here’s how shifting buyer and seller behavior in 2026 affects pricing, negotiation, and smart decision-making locally.

Are Buyers Finally Catching a Break? And What That Means for Sellers on the Fence in Kansas City

Mortgage rates stabilizing is bringing serious Kansas City buyers back--quietly but confidently. With inventory still tight in key neighborhoods, sellers who price and prepare well may face less competition now than later. This in-between window could be a smart move for KC homeowners on the fence.

Negotiation Is Back. Quietly. And It Changes Everything for High-End Sellers.

Negotiation is quietly reshaping the Kansas City luxury market. For $500K+ sellers, buyers are active again—but strategic. Inspections, concessions, and pricing conversations are normal, not red flags. In KC’s micro-markets, the sellers who prepare well and adapt are closing faster, cleaner, and with less stress.

New Year, New Market: What 2026 Is Quietly Setting Up for Kansas City Homebuyers and Sellers

January is reshaping the Kansas City housing market in subtle but powerful ways. Buyers are more intentional, sellers face less competition, and inventory is rising before spring pressure hits. For KC homeowners and buyers, this calmer, early-year window could be the smartest time to make a move.

Kansas City Housing Market Outlook: What 2026 Is Starting to Feel Like for Buyers and Sellers

As Kansas City heads into 2026, buyers and sellers are seeing a calmer, more strategic housing market. Inventory is up, pricing is sharper, and homes that are well-located and properly prepared still win. For KC buyers, there’s room to negotiate. For sellers, success now depends on smart pricing and strong presentation.

The Northland Real Estate Market: 2025 Wrap-Up & What to Expect in 2026

As 2025 ends, the Kansas City Northland proves to be a smart move for buyers and sellers over $600K. With balanced conditions, steady demand, and strong new construction, 2026 will reward well-priced homes and prepared buyers looking for space, value, and long-term livability north of the river.

What Today’s High-End Buyers Are Actually Doing

The Kansas City luxury market over $750K is not stalled, it is selective. Move-in-ready homes with strong locations and smart pricing are still selling, while average listings linger. For KC buyers and sellers, understanding this shift is critical to protecting equity, spotting leverage, and succeeding in today’s market.

2026 Kansas City Real Estate Market Forecast: What’s Really Going On and Why It Matters

Kansas City buyers and sellers heading into 2026 will find a steady, balanced market with real opportunity. Lower rates, rising sales, and KC’s affordability give buyers leverage, especially early, while sellers who price right and market well can still win. Strategy, not guesswork, is what pays off in KC next year.

Could a Capital Gains “Fix” Be the Housing Market’s Missing Ingredient?

Outdated capital gains rules may be quietly limiting inventory in Kansas City's higher-end housing market. For longtime owners, selling can trigger major tax bills, keeping homes off the market. If exclusions change, more KC sellers may list, giving buyers better options and easing competition in premium neighborhoods.

Buyer Behavior Influenced by Macro Sentiment

Kansas City buyers are pausing not because of rates, but because of broader economic uncertainty and price anxiety—especially above $600K. With slower pending sales and rising inventory, KC sellers must price strategically while buyers gain leverage in a more balanced market.